Property Taxes In Washington County Utah . An official website of utah county government. Washington county is rank 19th. 2023 tax rates by area. Look up property tax information and history by account or parcel number. washington county (0.46%) has a 16.4% lower property tax than the average of utah (0.55%). zillow has 8 photos of this $744,900 3 beds, 3 baths, 2,334 square feet single family home located at 112 centaurus way #112,. The values displayed are current as of january 1, 2024. Second homes, vacation homes, cabins, time. Your assessment and tax rate are shown on the front of your tax bill. Please update your bookmarks accordingly. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. qualified residential properties are taxed at 55% of their assessed market value. there are many different tax relief programs available for washington county (primary) property owners. Taxes are based upon the location and status of property as of january 1 of each year. The exemption applies to the home and up.

from diaocthongthai.com

Second homes, vacation homes, cabins, time. there are many different tax relief programs available for washington county (primary) property owners. qualified residential properties are taxed at 55% of their assessed market value. The counties’ role begins with the. Please update your bookmarks accordingly. 2023 tax rates by area. Washington county is rank 19th. Your assessment and tax rate are shown on the front of your tax bill. a qualifying property is assessed and taxed based on the remaining 55% of market value. the washington county treasurer’s office is pleased to offer a range of helpful information for the taxpayers of.

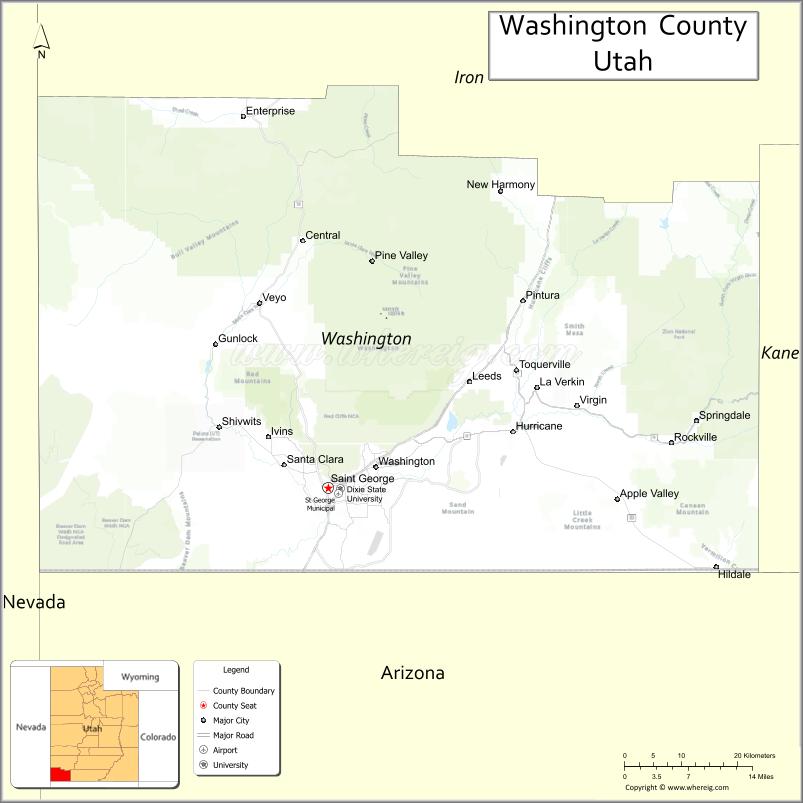

Map of Washington County, Utah Thong Thai Real

Property Taxes In Washington County Utah the washington county treasurer’s office is pleased to offer a range of helpful information for the taxpayers of. assessment & tax rate. The counties’ role begins with the. Second homes, vacation homes, cabins, time. — there are two large factors behind the property tax hike in washington county: The exemption applies to the home and up. Property tax bills and payments. there are many different tax relief programs available for washington county (primary) property owners. property values are for tax purposes only. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. — what does that mean for washington county property owners? Interact, search, and download with. the washington county treasurer’s office is pleased to offer a range of helpful information for the taxpayers of. Taxes are based upon the location and status of property as of january 1 of each year. For most, the short answer is to expect a significant tax increase this year. residential property tax in utah is administered by the 29 county governments.

From gpsrenting.com

How To Pay Property Tax In Washington State Step By Step GPS Renting Property Taxes In Washington County Utah Interact, search, and download with. assessment & tax rate. The values displayed are current as of january 1, 2024. property values are for tax purposes only. For most, the short answer is to expect a significant tax increase this year. zillow has 8 photos of this $744,900 3 beds, 3 baths, 2,334 square feet single family home. Property Taxes In Washington County Utah.

From gioeychzf.blob.core.windows.net

Ogden Utah Property Records at Linda Carpenter blog Property Taxes In Washington County Utah An official website of utah county government. Please update your bookmarks accordingly. How do i find out about the tax sale? property values are for tax purposes only. zillow has 8 photos of this $744,900 3 beds, 3 baths, 2,334 square feet single family home located at 112 centaurus way #112,. the following documents show the tax. Property Taxes In Washington County Utah.

From discoverutahcounties.weebly.com

Washington County Discover Utah Counties Property Taxes In Washington County Utah 2022 tax rates by area. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Questions about your property tax bill and payments are handled by your local. — what does that mean for washington county property owners? the washington county treasurer’s. Property Taxes In Washington County Utah.

From exopxikln.blob.core.windows.net

Property Tax Rate Washington County Utah at Wallace Denby blog Property Taxes In Washington County Utah How do i find out about the tax sale? a qualifying property is assessed and taxed based on the remaining 55% of market value. Property acquired in 2024 is not. The increasingly high valuation of. To calculate your bill, multiply the. This webpage has been moved here. the county assessor is responsible for listing, valuing and maintaining records. Property Taxes In Washington County Utah.

From opportunitywa.org

Washington state and local governments rank 29th in reliance on Property Taxes In Washington County Utah This webpage has been moved here. Taxes are based upon the location and status of property as of january 1 of each year. Questions about your property tax bill and payments are handled by your local. Property tax bills and payments. An official website of utah county government. the following documents show the tax rates listed by area. Second. Property Taxes In Washington County Utah.

From www.kiplinger.com

Washington State Tax Guide Sales, and Property Taxes Kiplinger Property Taxes In Washington County Utah property values are for tax purposes only. Property tax bills and payments. The values displayed are current as of january 1, 2024. — what does that mean for washington county property owners? residential property tax in utah is administered by the 29 county governments. Taxes are based upon the location and status of property as of january. Property Taxes In Washington County Utah.

From exowfeonn.blob.core.windows.net

Houses For Rent In Washington County Tx at Phillip Robinson blog Property Taxes In Washington County Utah This webpage has been moved here. the washington county treasurer’s office is pleased to offer a range of helpful information for the taxpayers of. the county assessor is responsible for listing and valuing all taxable real and personal property in washington county. Each may, the washington county clerk. the county assessor is responsible for listing, valuing and. Property Taxes In Washington County Utah.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Property Taxes In Washington County Utah The increasingly high valuation of. property values are for tax purposes only. Questions about your property tax bill and payments are handled by your local. assessment & tax rate. Second homes, vacation homes, cabins, time. Each may, the washington county clerk. 2022 tax rates by area. property taxes can be paid by an automatic withdrawal of funds. Property Taxes In Washington County Utah.

From taxunfiltered.com

2023 State Business Tax Climate Index Tax Unfiltered Property Taxes In Washington County Utah property values are for tax purposes only. washington county (0.46%) has a 16.4% lower property tax than the average of utah (0.55%). 2022 tax rates by area. This webpage has been moved here. assessment & tax rate. How do i find out about the tax sale? An official website of utah county government. The values displayed are. Property Taxes In Washington County Utah.

From leaveadvice.com

Property Tax In Washington State A Complete Guide Property Taxes In Washington County Utah Your assessment and tax rate are shown on the front of your tax bill. Look up property tax information and history by account or parcel number. the county assessor is responsible for listing and valuing all taxable real and personal property in washington county. Second homes, vacation homes, cabins, time. assessment & tax rate. The exemption applies to. Property Taxes In Washington County Utah.

From exorqduie.blob.core.windows.net

Washington State Property Tax Year at Robert Dayton blog Property Taxes In Washington County Utah An official website of utah county government. Interact, search, and download with. a qualifying property is assessed and taxed based on the remaining 55% of market value. — there are two large factors behind the property tax hike in washington county: Please update your bookmarks accordingly. — washington county property owners, the 2021 “notice of property valuation. Property Taxes In Washington County Utah.

From www.cashreview.com

State Corporate Tax Rates and Brackets for 2023 CashReview Property Taxes In Washington County Utah Look up property tax information and history by account or parcel number. Property tax bills and payments. For most, the short answer is to expect a significant tax increase this year. property values are for tax purposes only. Second homes, vacation homes, cabins, time. washington county (0.46%) has a 16.4% lower property tax than the average of utah. Property Taxes In Washington County Utah.

From willabellaomady.pages.dev

Minimum Wage 2024 Wa State Tax Kiele Merissa Property Taxes In Washington County Utah the median property tax (also known as real estate tax) in washington county is $1,231.00 per year, based on a median. Property acquired in 2024 is not. An official website of utah county government. — what does that mean for washington county property owners? qualified residential properties are taxed at 55% of their assessed market value. The. Property Taxes In Washington County Utah.

From housedemocrats.wa.gov

The truth about taxes in Washington Washington State House Democrats Property Taxes In Washington County Utah Please update your bookmarks accordingly. assessment & tax rate. 2023 tax rates by area. Taxes are based upon the location and status of property as of january 1 of each year. property taxes can be paid by an automatic withdrawal of funds from your checking account. the county assessor is responsible for listing, valuing and maintaining records. Property Taxes In Washington County Utah.

From learningschoolhappybrafd.z4.web.core.windows.net

Virginia State Sales Tax Rate 2024 Property Taxes In Washington County Utah Each may, the washington county clerk. The values displayed are current as of january 1, 2024. washington county (0.46%) has a 16.4% lower property tax than the average of utah (0.55%). Property tax bills and payments. property values are for tax purposes only. Please update your bookmarks accordingly. For most, the short answer is to expect a significant. Property Taxes In Washington County Utah.

From dxoflgxlh.blob.core.windows.net

Wa State Assessor S Office at Nancy Montoya blog Property Taxes In Washington County Utah property taxes can be paid by an automatic withdrawal of funds from your checking account. Questions about your property tax bill and payments are handled by your local. An official website of utah county government. the following documents show the tax rates listed by area. — there are two large factors behind the property tax hike in. Property Taxes In Washington County Utah.

From www.kiplinger.com

Washington State Tax Guide Sales, and Property Taxes Kiplinger Property Taxes In Washington County Utah — what does that mean for washington county property owners? Your assessment and tax rate are shown on the front of your tax bill. The counties’ role begins with the. Each may, the washington county clerk. Questions about your property tax bill and payments are handled by your local. the following documents show the tax rates listed by. Property Taxes In Washington County Utah.

From movingist.com

Cost of living in Washington State (Taxes, Housing & More) Property Taxes In Washington County Utah the median property tax (also known as real estate tax) in washington county is $1,231.00 per year, based on a median. How do i find out about the tax sale? a qualifying property is assessed and taxed based on the remaining 55% of market value. The counties’ role begins with the. Property acquired in 2024 is not. 2022. Property Taxes In Washington County Utah.